Sales discounts are often expressed as a percentage of the sales price and can be offered to encourage customers to pay their invoices within a specified period or for purchasing products in bulk. Trade discounts and sales discounts are the two main types of discounts in accounting that might occur in businesses. Trade discounts take place when the seller reduces the sales price for a wholesale customer, such as on bulk orders. A sales discount, on the other hand, occurs when a seller offers a sales price reduction to a customer as an incentive to pay an invoice within a certain time.

What Are Sales Discounts?

Expenses, on the other hand, also have a natural debit balance; as explained before this is not in any way the reason for sales discount being recorded as a debit. Sales discount is debited as a contra revenue account and not as an expense. Therefore, if the customer doesn’t pay within 10 days, the customer doesn’t get the discount and pays the full price of the goods or services within 30 days after the invoice date. Another common example is the ‘1/10 net 30‘, whereby the customer takes a 1 percent discount in exchange for paying within 10 days of the invoice date. Hence, if not met, the customer makes the full-price payment within 30 days after the invoice date. On the other hand, the net method records the sale at the discounted amount from the outset.

Submit to get your retirement-readiness report.

A sales discount is a reduction in the price of a product or service that is offered by the seller, in exchange for early payment by the buyer. A sales discount may be offered when the seller is short of cash, or if it wants to reduce the recorded amount of its receivables outstanding for other reasons. Sales discounts, also known as cash discounts or early payment discounts, are reductions in the amount a customer has to pay if they settle their invoice before the due date. These discounts incentivize early payment, helping businesses improve their cash flow. It is a reduction of gross sales which correspondingly causes a decrease in the net sales figure.

Initial Recognition of Sales Transaction:

As we mentioned above, the customer paid early and got a 2% discount – $20, which has to be considered. You record this discount in the Sales Discounts account, which is a contra revenue account. Trade discounts are given at the time of sale, usually to encourage bulk purchases or reward long-term business relationships. These discounts are applied directly to the sale price before it’s recorded in the accounting books, meaning the discounted price is what gets recorded, not the original price. Thus, companies should ascertain whether or not offering sales discounts will truly benefit them in the long run.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Trade discount refers to the reduction in the price of a commodity or service sold to wholesalers at the time of bulk purchases. When dealing with returns or allowances, you adjust your financial records to reflect these changes. The second method is a bit more straightforward and involves applying a single discount to the entire transaction. Instead of breaking down the discount into separate line items, Synder will store all discounts under one account that you choose in the settings. Sales discounts have a direct impact on different parts of the financial statements, influencing how the business’s financial performance is perceived.

- Sales discounts are otherwise called cash discounts or early payment discounts.

- If the customer pays within 10 days then a 2.5% sales discount amounting to 50 can be deducted from the sales invoice, and the customer will pay only 1,950 to settle the account.

- The full amount owed by the customer is shown as a balance sheet asset (accounts receivable) and included as revenue in the income statement.

- When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for is sales discount an expense convenience purposes only and all users thereof should be guided accordingly. It is offered to the purchaser if they are able to pay off their credit purchases in a given period.

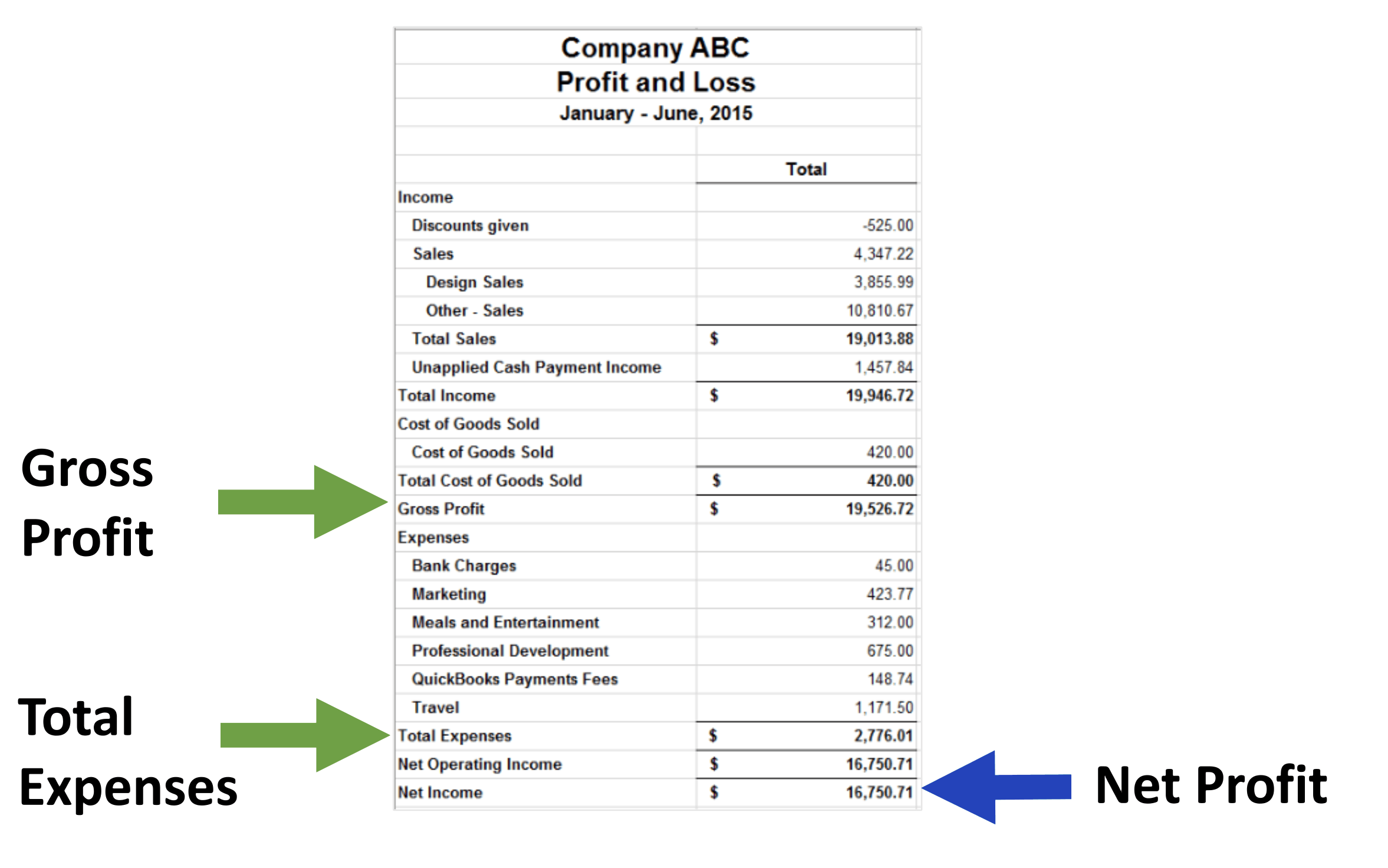

Hence, a company’s net profit is the total revenue generated minus its expenses. That is, in order to calculate the profitability of a business, expenses are deducted from revenue. Revenue is reported on the credit side while expenses are recorded on the debit side of the profit and loss report in order to measure a business’s profit and losses.

This reduction in gross profit can impact key financial ratios, such as the gross profit margin, which investors and analysts closely monitor to assess a company’s profitability and operational efficiency. Trade discounts are reductions in the listed price of goods or services, typically offered to specific customers such as wholesalers, retailers, or bulk buyers. These discounts are not recorded in the accounting books as separate entries; instead, the sale is recorded at the net price after the discount. For example, if a product listed at $1,000 is sold to a retailer at a 10% trade discount, the sale is recorded at $900.

When coupons are issued, the entity will not recognize anything in its books until the coupon is redeemed. When the coupon is redeemed, the Revenue is recorded either net of the discount coupon immediately, or the discount is first recorded in the contra-revenue account, and then later netted off of the Revenue figure. Let’s discuss the step by the step accounting treatment of sales discount. It is also not shown in the face of financial statements as well as in the noted to sales or revenue of financial reports.