There is at present no such client safety when it comes to cryptocurrencies. Here is what regulation may imply for cryptocurrency investors andcrypto-asset companies. The digital tokens, which emerged in 2014, can be thought of as certificates of possession for virtual or bodily assets. NFTs have a unique digital signature which suggests they can’t be copied or replicated. So-called “stablecoins” will turn out to be recognised types of payment to offer people confidence in utilizing digital currencies, it mentioned.

While some cryptoassets are exterior the FCA’s perimeter, funding merchandise corresponding to derivatives contracts that reference these cryptoassets are prone to be within our perimeter, as we’ve previously acknowledged. These proposals will place responsibility on crypto buying and selling venues for defining the detailed content material requirements for admission and disclosure paperwork – guaranteeing crypto exchanges have fair and sturdy requirements. As quickly as the legislation is handed, the U.K Treasury department will be capable of enforce regulation over the crypto market.

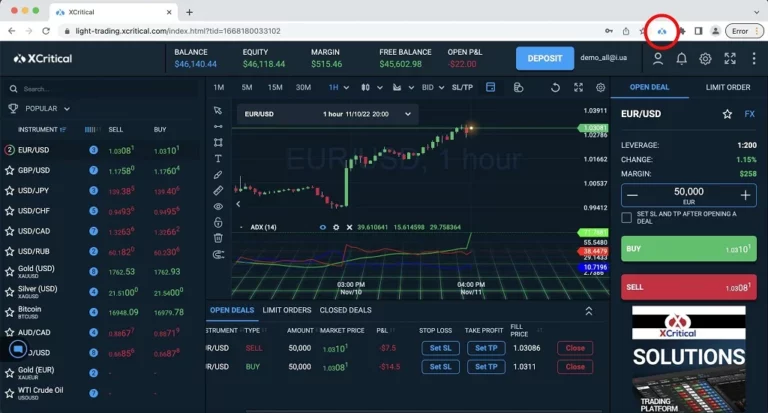

Any crypto businesses operating before January 2021 can trade on an interim licence until a call is made on their anti-money laundering registration by the FCA. It might not hit virtual currencies directly however cryptoasset change providers might be affected. For instance, the ASA banned two Crypto.com advertisements earlier this yr, claiming that the buying and selling platform didn’t successfully show the dangers of investing in cryptocurrencies. One area the place you will discover some regulation is when buying or buying and selling cryptocurrencies through an exchange. While cryptocurrencies aren’t regulated, the taxman has already taken an interest within the sector.

Weekend Print + Normal Digital

The “same risk, identical regulatory outcome” principle underpins the strategy to cryptoassets, with the regime expecting cryptoassets activities to fulfill the same regulatory standards expected of comparable traditional FS actions. The proposed activity-based framework covers a broad suite of crypto activities, and references new powers that HMT is about to receive via the Financial Services and Markets Bill (FSMB). The cryptoasset financial promotions regime applies to all firms marketing cryptoassets to UK customers, regardless of whether the firm is based overseas or what know-how is used to make the promotion. “We have been clear on the necessity for the monetary promotions regime to be prolonged to cowl cryptoassets. Cryptoasset businesses advertising to UK customers, together with corporations primarily based overseas, should begin preparing now for this regime,” stated the FCA. Significant work lies ahead to flesh out the element and fine-tune these frameworks to the nuances of the crypto trade.

Ambitious plans to protect customers and develop the economic system by robustly regulating cryptoasset activities have been announced by the government. The vision she referred to is likely related to statements from newly appointed U.K Prime Minister Rishi Sunak. During Sunak’s tenure as Chancellor of the Exchequer in April 2021, he proposed that the Bank of England and HM Treasury create a task pressure to judge the creation of a central bank digital forex. That would imply exchanges, buying and selling platforms and cryptoasset suppliers would need to guarantee that customers understand the numerous dangers of what they’re buying. The quantity of labor ahead indicates that we are unlikely to see all the primary points of the UK’s method in 2023. With a session response and a raft of secondary legislation and FCA consultations to comply with, our estimate is that comprehensive regulatory readability will take as much as three years.

Financial Crime And Corporate Transparency Act: Cryptoassets – Key Terms And Definitions

DTTL and every of its member companies are legally separate and impartial entities. Please see About Deloitte to study extra about our global community of member corporations. The UK stays dedicated to making a regulatory setting in which corporations can innovate, while crucially maintaining monetary stability and clear regulatory standards so that people can use new applied sciences both reliably and safely. As is frequent in emerging expertise markets, the crypto sector continues to experience excessive ranges of volatility and a number of latest failures have exposed the structural vulnerability of some business models within the sector.

In addition, to address industry considerations about the small variety of Financial Conduct Authority (FCA) authorised cryptoasset companies who can issue their own promotions, HM Treasury can additionally be introducing a time restricted exemption. Cryptoasset businesses which might be registered with the FCA for anti-money laundering purposes cryptocurrency regulations uk shall be allowed to issue their own promotions, whereas the broader cryptoasset regulatory regime is being launched. There is no regulation of cryptocurrencies however crypto businesses providing providers with digital tokens must be approved and register with the FCA for anti-money laundering rules.

All Eyes On New Prime Minister

She is a professional Chartered Accountant and has beforehand worked in Deloitte’s Audit, Corporate Finance and Risk Advisory groups, the place she led large-scale regulatory change tasks. After setting out its plan with regard to fiat-backed stablecoins in 2022, as a half of the next wave of regulation, the Government plans to deliver different key actors including exchanges and custodians throughout the regulatory perimeter. As anticipated, the UK will draw on (but tailor) existing regulatory frameworks (e.g. MiFID) that apply to conventional financial services.

In the meantime, Treasury officials will seek the assistance of with related stakeholders to ensure the framework maximizes crypto advantages and addresses risks. They must guarantee their advertising and platforms adjust to guidelines on monetary promotions that say the dangers of a product must be made clear. It banned Binance, one of many world’s largest crypto exchanges, from operating in the UK in 2021 amid considerations about the business construction, how consumers purchase products and its legal owner. All crypto asset companies operating within the UK should register for anti-money laundering permissions with the FCA. If you earn more than this by selling a cryptoasset then you might have to pay capital features tax.

What Are Nfts And The Way Do Non-fungible Tokens Work?

Cryptocurrencies are digital or digital currencies that could be traded or used to buy items and providers, although not many outlets settle for them yet and a few nations have banned them altogether. The Treasury has not but confirmed which stablecoins might be regulated; well-known ones include Tether and Binance USD. Stablecoins are designed to have a secure worth linked to conventional currencies or belongings like gold. Deloitte LLP is the United Kingdom affiliate of Deloitte NSE LLP, a member agency of Deloitte Touche Tohmatsu Limited, a UK non-public company limited by assure (“DTTL”).

You can also complain to the Financial Ombudsman Service if you’re unhappy about a regulated service or product or if you assume you’ve been mis-sold. The BBC explains why the biggest crypto-exchange platform on the earth faces legal bother in Nigeria. Sir Jon Cunliffe informed the BBC that if the worth of cryptocurrencies fell sharply, it could have a knock-on impact.

Other kinds of cryptoassets embrace decentralised finance platforms that use blockchain expertise to supply companies corresponding to crypto-backed loans. Overall, the crypto ecosystem will welcome the UK Government’s clear commitment to develop a comprehensive cryptoassets framework. Once the details are fleshed out over the subsequent few years, the UK should have a structured regime that can allow actors to determine how and where to play in the UK’s regulated crypto ecosystem. In July 2019, The Economic Crime Plan announced that from January 10, 2020 the FCA will be the Anti Money Laundering and Countering Terrorist Financing (AML/CTF) supervisor for companies carrying on sure cryptoasset activity. The move follows a yr of acute turbulence within the digital asset trade, which included the collapse of Sam Bankman-Fried’s FTX cryptocurrency empire and lender Celsius, which left people globally with billions of dollars in frozen funds.

- “We stay steadfast in our dedication to develop the economy and allow technological change and innovation – and this contains cryptoasset know-how.

- International companies might start now to construct a clear view of the extent to which they want to serve UK prospects and consider the UK’s emerging regulatory approach as a half of growth plans.

- There isn’t any regulation of cryptocurrencies but crypto businesses offering providers with digital tokens should be approved and register with the FCA for anti-money laundering laws.

- While cryptocurrencies aren’t regulated, the taxman has already taken an interest in the sector.

- For instance, the ASA banned two Crypto.com ads earlier this yr, claiming that the trading platform didn’t successfully show the dangers of investing in cryptocurrencies.

He is but to approve his ability to take care of his place within the coming months. For instance crypto influencer Matt Lorion needed to apologise to his TikTok followers in April 2021 after he had promoted the Mando cryptocurrency to his hundreds of thousands of followers, which turned out to be a scam. They might promise future earnings however typically are being paid to advertise a particular token or to share in any of the value growth.

That means if an organization you’ve your financial savings or investments with collapses, up to £85,000 of your cash might be protected. It is with these factors in thoughts that the City watchdog is seeking to regulate the sector where it could. Kabosu, a Japanese shiba inu, inspired the viral “doge” meme and became the face of Dogecoin cryptocurrency. The process of producing digital cash by way of banks of powerful computers, known as mining, is also extremely power intensive. Recent analysis suggests Bitcoin now generates carbon emissions comparable to the nation of Greece. “But we think that by making this nation a hospitable place for crypto we are able to attract investment [and] generate swathes of new jobs.”