In the fast-paced world of online trading, having an effective strategy can be the key to success. For traders using the pocket option strategy Pocket Option official platform, understanding the nuances of market behavior and implementing solid strategies can significantly increase your chances of making profitable trades. This article will delve into some of the most effective Pocket Option strategies that traders can employ to boost their performance.

Understanding Pocket Option

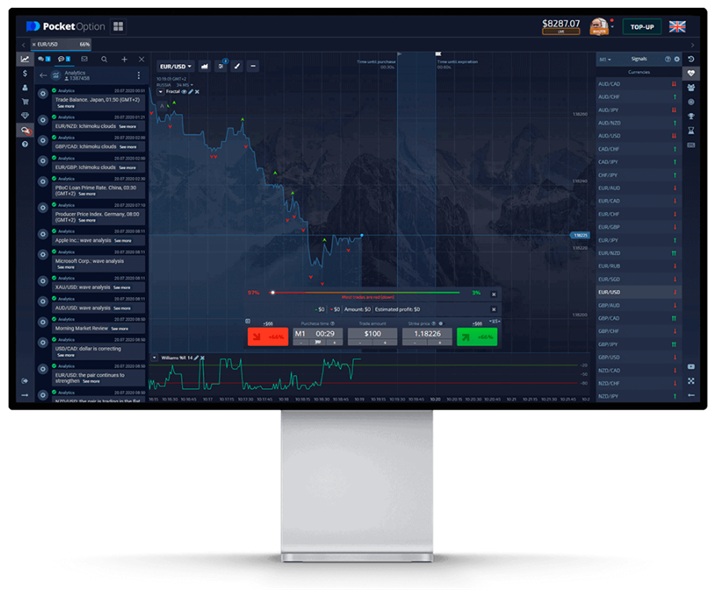

Pocket Option is a popular online trading platform that offers a user-friendly interface and a wide range of trading options. It allows traders to engage in various asset classes, including forex, cryptocurrencies, and stocks. The platform is known for its high payouts and easy access, making it a preferred choice for both beginners and experienced traders. To make the most of this platform, it’s essential to adopt strategies that can help minimize risks and maximize returns.

1. Technical Analysis Basics

One of the most fundamental strategies for trading on Pocket Option lies in mastering technical analysis. This involves studying price charts, indicators, and historical price movements to make informed trading decisions. Here are some key components of technical analysis:

- Charts: Familiarize yourself with different chart types such as line, bar, and candlestick charts. Each type provides unique insights into market trends and price action.

- Indicators: Utilize popular technical indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to help predict future price movements.

- Support and Resistance Levels: Identify key support and resistance levels to determine potential trade entry and exit points.

2. Trend Following Strategy

One effective approach to trading on Pocket Option is the trend-following strategy. This involves analyzing market trends and executing trades in the direction of those trends. Here’s how to implement this strategy:

- Identify the Trend: Use technical analysis to determine whether the market is in an uptrend, downtrend, or ranging.

- Trade in the Direction of the Trend: If the market is in an uptrend, look for opportunities to buy. Conversely, in a downtrend, consider selling.

- Set Stop Loss and Take Profit Levels: Always manage risk by setting stop-loss orders to protect against adverse price movements. Determine your take profit levels to secure gains on your trades.

3. The 5-Minute Strategy

For traders who enjoy fast-paced trading, the 5-minute strategy is a popular choice. This strategy involves executing trades with a short expiry time. Here’s how it works:

- Trade during Volatile Hours: Focus your trading during periods of high volatility, often observed around economic news releases.

- Use Short-term Indicators: Implement indicators suited for shorter time frames, such as the Stochastic Oscillator and RSI, to make quick trading decisions.

- Enter and Exit Quickly: With the short expiry time, it’s crucial to enter and exit trades rapidly based on market conditions.

4. News Trading Strategy

News trading capitalizes on market volatility caused by economic announcements and news events. Here’s how to effectively use this strategy:

- Stay Informed: Monitor economic calendars and stay updated on major news events that could impact the market.

- Trade the Reaction: After a news release, observe how the market reacts and look for trading opportunities based on the price action.

- Manage Risk: Given the unpredictable nature of news events, ensure you set tight stop-loss levels to manage your risk effectively.

5. Utilizing a Demo Account

Before diving into real trading, it’s advisable to practice your strategies using Pocket Option’s demo account. A demo account offers a risk-free environment where you can test different strategies and refine your trading skills. Here’s how to make the most of your demo account:

- Try Different Strategies: Experiment with various trading strategies to determine which ones resonate with your trading style.

- Analyze Performance: Keep track of your trades and analyze what works and what doesn’t to continuously improve your trading approach.

- Gain Confidence: Use the demo account to build your confidence before transitioning to live trading.

6. Risk Management

Effective risk management is paramount to long-term success in trading. Here are some key risk management tips for Pocket Option traders:

- Define Your Risk Tolerance: Determine how much capital you are willing to risk on each trade and stick to it.

- Diversify Your Trades: Avoid putting all your capital into a single trade or asset. Diversifying can help mitigate risks.

- Use Stop Losses: Always implement stop-loss orders to protect your capital from significant losses.

7. Continuous Learning and Adaptation

The market is constantly evolving, and successful traders are those who adapt to changes. Continuously educate yourself by:

- Reading trading books and articles.

- Participating in online trading forums.

- Following expert traders and analyzing their strategies.

Conclusion

Trading on Pocket Option can be a rewarding venture if approached with the right strategies and mindset. By focusing on technical analysis, trend-following, risk management, and continuous learning, traders can improve their chances of success. Whether you are a novice or an experienced trader, implementing these strategies can help you navigate the market with confidence. Remember, consistency and discipline are key to mastering trading on the Pocket Option platform.