Understanding Global Forex Trading: Strategies, Market Dynamics, and Future Trends

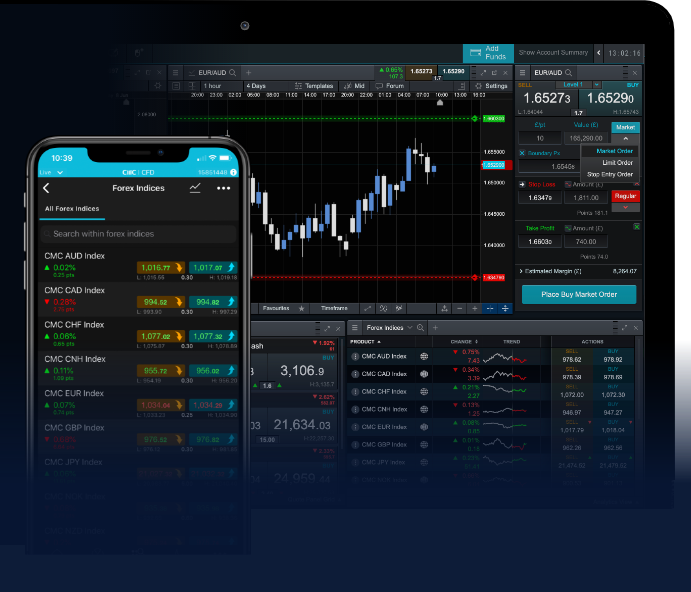

Forex trading, or foreign exchange trading, represents one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. This extensive market is characterized by the buying and selling of currencies, which fluctuates in value based on various economic and geopolitical factors. Traders and investors engage in forex trading not only for potential profit but also as a means of hedging against currency risk. In this article, we will explain the basics of global forex trading, its mechanisms, popular strategies, and future trends in this dynamic market. Furthermore, if you’re looking for seamless trading experiences, consider using a global forex trading Crypto Trading App to facilitate your transactions.

Understanding the Forex Market

The forex market is a decentralized market, meaning there is no central exchange where trades are conducted. Instead, trades occur over-the-counter (OTC) via networks of banks, brokers, and financial institutions. The market operates 24 hours a day, five days a week, due to the overlapping time zones of major financial centers across the globe, such as London, New York, Tokyo, and Sydney. This continuous operation allows traders to react to global events and market changes in real-time.

Currency Pairs in Forex Trading

In forex trading, currencies are always quoted in pairs — for example, EUR/USD or USD/JPY. The first currency in the pair is called the base currency, while the second is the quote currency. The value of the currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. Traders speculate on the price movements of these pairs by buying (going long) or selling (going short) based on their predictions.

Types of Currency Pairs

There are three main types of currency pairs in forex trading:

- Major Pairs: These include the most traded currencies, such as EUR/USD, GBP/USD, and USD/JPY. They tend to have low spreads and high liquidity.

- Minor Pairs: These pairs include currencies that are not as frequently traded, such as EUR/GBP or AUD/NZD. They can have higher spreads owing to lower liquidity.

- Exotic Pairs: These are rare combinations of major currencies with emerging market currencies, like USD/THB (Thai Baht) or EUR/MXN (Mexican Peso). Exotic pairs often carry a higher risk due to lower market activity.

Forex Trading Strategies

Successful forex trading relies heavily on strategic planning, based on analyses of market conditions and price movements. Below are some of the most popular trading strategies used:

1. Day Trading

Day trading involves entering and exiting trades within the same trading day. Traders typically focus on short-term price movements and may execute several trades in a single day to capitalize on small fluctuations.

2. Swing Trading

Swing trading involves holding trades for a period of days or weeks, allowing traders to capitalize on larger price movements or trends. This strategy relies on technical analysis to identify potential reversals or continuations in price action.

3. Position Trading

Position trading is a long-term strategy, where traders hold their positions for months or even years, based on fundamental analysis of various economic indicators and events. This strategy requires deep understanding and patience but can provide significant returns over time.

4. Scalping

Scalping is a high-frequency trading strategy that seeks to capture small price movements multiple times throughout the day. Scalpers usually rely on quick execution and a robust trading platform to complete their trades effectively.

Market Analysis Techniques

To develop effective trading strategies, traders often utilize two primary forms of market analysis: fundamental and technical analysis.

Fundamental Analysis

This type of analysis involves evaluating economic indicators, interest rates, GDP, political stability, and other factors that can influence currency values. By understanding the broader economic context, traders can make informed predictions about currency movements.

Technical Analysis

Technical analysis focuses on historical price data and trading volumes to identify trends and patterns. Traders use various tools, such as charts, indicators, and candlestick patterns, to forecast future price movements based on past performance.

Risks of Forex Trading

While forex trading can be lucrative, it also carries inherent risks that traders must be aware of. The volatile nature of currency markets can lead to significant losses, especially for those who are inexperienced or trading on margin. Here are some common risks associated with forex trading:

1. Market Risk

Fluctuations in currency values due to market events can lead to immediate losses. Traders must be prepared to face sudden shifts, which can occur due to economic data releases, geopolitical tensions, or unexpected events.

2. Leverage Risk

Forex trading often involves the use of leverage, allowing traders to control larger positions than their account balance would normally permit. While leverage can amplify profits, it can also lead to significant losses, even wiping out entire accounts.

3. Interest Rate Risk

Central banks control interest rates, and changes in these rates can impact currency values. Unexpected changes can lead to sharp market movements that catch traders off guard.

4. Psychological Risks

Emotions can heavily influence trading decisions. Fear and greed can lead to poor decision-making, resulting in impulsive trades and potential losses. Successful traders develop discipline and emotional control to manage their trading effectively.

Future Trends in Forex Trading

The forex market is continually evolving, with several trends likely to shape its future:

- Increase in Algorithmic Trading: More traders are leveraging automated systems to execute trades based on pre-defined criteria, reducing the influence of human emotion.

- Rise of Cryptocurrencies: The increased popularity and acceptance of cryptocurrencies as a trading asset are creating new opportunities and challenges in forex trading.

- Regulatory Changes: As the forex market grows, so does scrutiny from regulators, leading to changes in trading practices and requirements.

- Technological Advancements: Innovations in trading technology, such as artificial intelligence and machine learning, are enhancing analysis and decision-making abilities.

Conclusion

Global forex trading presents numerous avenues for profit but also encompasses significant risks. Understanding market mechanics, employing effective strategies, and utilizing proper analytical tools can enhance trading success. As the market continues to evolve with technological advancements and new regulations, staying informed will be essential for traders looking to thrive in this competitive landscape. Whether you’re a seasoned trader or just starting in the world of forex, ongoing education and adaptation will be key to your success.