Understanding Forex Trading: A Comprehensive Guide

Forex trading, or foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. It is one of the largest and most liquid financial markets in the world, with an average daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, allowing traders to enter and exit positions at any time. If you’re interested in exploring the world of currency trading, the forex trading definition Best Platforms for Trading can help you get started.

The Basics of Forex Trading

At its core, forex trading involves the exchange of one currency for another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). In these pairs, the first currency is called the base currency, while the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

For example, if the EUR/USD exchange rate is 1.1500, it means 1 Euro can be exchanged for 1.15 US Dollars. When trading forex, traders speculate on whether a currency pair’s value will rise or fall. If they believe the base currency will strengthen against the quote currency, they will buy the pair. Conversely, if they believe the base currency will weaken, they would sell the pair.

Market Participants

Several key players participate in the forex market, including:

- Central Banks: They influence currency value through monetary policy and intervention strategies.

- Commercial Banks: Major banks conduct transactions on behalf of clients and trade for their own accounts.

- Institutional Investors: Hedge funds and investment firms trade large volumes, often impacting market prices.

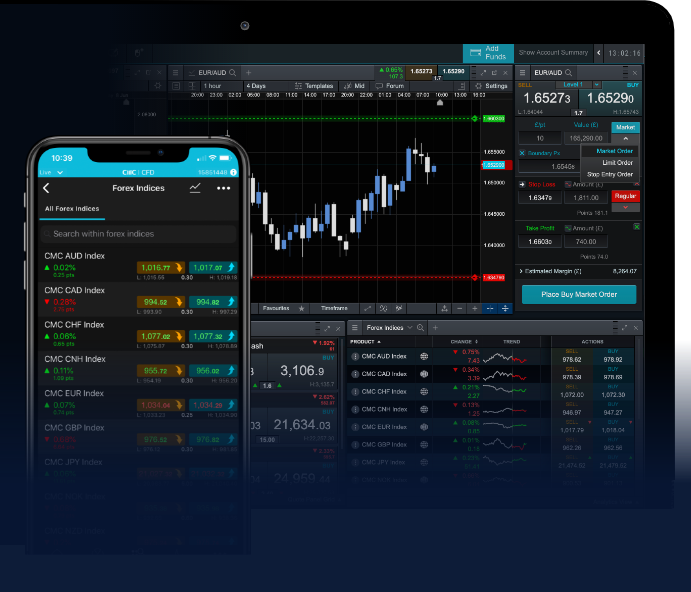

- Retail Traders: Individual traders who engage in the forex market using online trading platforms.

Types of Forex Orders

Forex traders use various types of orders to execute their trades efficiently:

- Market Orders: These orders are executed immediately at the current market price.

- Limit Orders: Traders set a specific price to buy or sell, and the order will be executed once the market reaches that price.

- Stop Loss Orders: An order set to limit potential losses. It automatically closes a position if the market moves against the trader.

- Take Profit Orders: Automated orders that close a position once a predetermined profit level is reached.

Benefits of Forex Trading

Forex trading offers several advantages that attract both novice and experienced traders:

- High Liquidity: The forex market’s immense trading volume ensures that transactions can be made quickly and easily.

- Leverage: Many brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital.

- Accessibility: With online trading platforms, anyone with an internet connection can participate in the forex market.

- Diverse Trading Options: Traders can choose from a wide range of currency pairs and trade different strategies.

Forex Trading Strategies

Successful forex trading requires a solid strategy. Here are a few popular trading strategies:

- Scalping: This strategy involves making small profits from numerous trades throughout the day.

- Day Trading: Day traders open and close positions within the same day, taking advantage of intraday price movements.

- Swing Trading: Swing traders hold positions for several days or weeks to capture larger price movements.

- Position Trading: This long-term strategy involves holding trades for weeks, months, or even years, based on fundamental analysis.

Risks Associated with Forex Trading

While forex trading offers opportunities, it’s important to recognize the risks. Key risks include:

- Market Risk: Currency prices can fluctuate significantly due to economic news, geopolitical events, or market sentiment.

- Leverage Risk: While leverage can amplify profits, it can also magnify losses, risking significant capital.

- Counterparty Risk: The risk that a broker might not fulfill its obligations, especially during periods of high volatility.

Conclusion

Forex trading can be a rewarding venture for those willing to learn about the market and develop effective trading strategies. By understanding the definition of forex trading, the mechanics of the currency market, and the risks involved, traders can make informed decisions and potentially achieve their financial goals. Whether you are a beginner or an experienced trader, continuous education and practice remain essential components of forex trading success.